Tailored GRC Solutions for Fintech

Helping fintechs scale securely, stay compliant, and earn trust.

Win GRC partners with fintech innovators to build resilient governance, risk, and compliance programs. From regulatory onboarding to continuous audit readiness, we offer clear, defensible, and future-proof strategies aligned to your operational and regulatory realities.

Compliance Management

Policy & Controls Architecture

Internal Audit & Assurance

Vendor & Third-Party Risk

GRC Expertise Designed for the Fintech Frontier

Win GRC is a specialized consultancy delivering Governance, Risk, and Compliance services to fintech companies navigating regulated and high-growth environments. With our background in cybersecurity, finance, law, and data engineering, we bridge the gap between technical implementation and regulatory obligation—delivering controls that function as intended, and audits that validate your discipline.

We serve as long-term partners, not checkbox vendors—bringing a blend of strategic insight, hands-on delivery, and a commitment to operational excellence.

The Strategic Role of GRC in Fintech

Fintech firms operate at the intersection of finance, data, and software—each domain governed by stringent, evolving regulations. Whether managing payment flows, consumer data, crypto assets, or banking APIs, trust and transparency are non-negotiable.

GRC is not an afterthought—it is foundational.

Without disciplined governance and structured controls, fintechs risk:

-

Delayed licensing and banking partnerships

-

Failed audits or SOC 2 readiness assessments

-

Regulatory investigations and fines

-

Data breaches and reputational damage

-

Broken customer and investor confidence

Win GRC helps you build a proactive, measurable, and defensible GRC foundation from day one.

Our Core Services

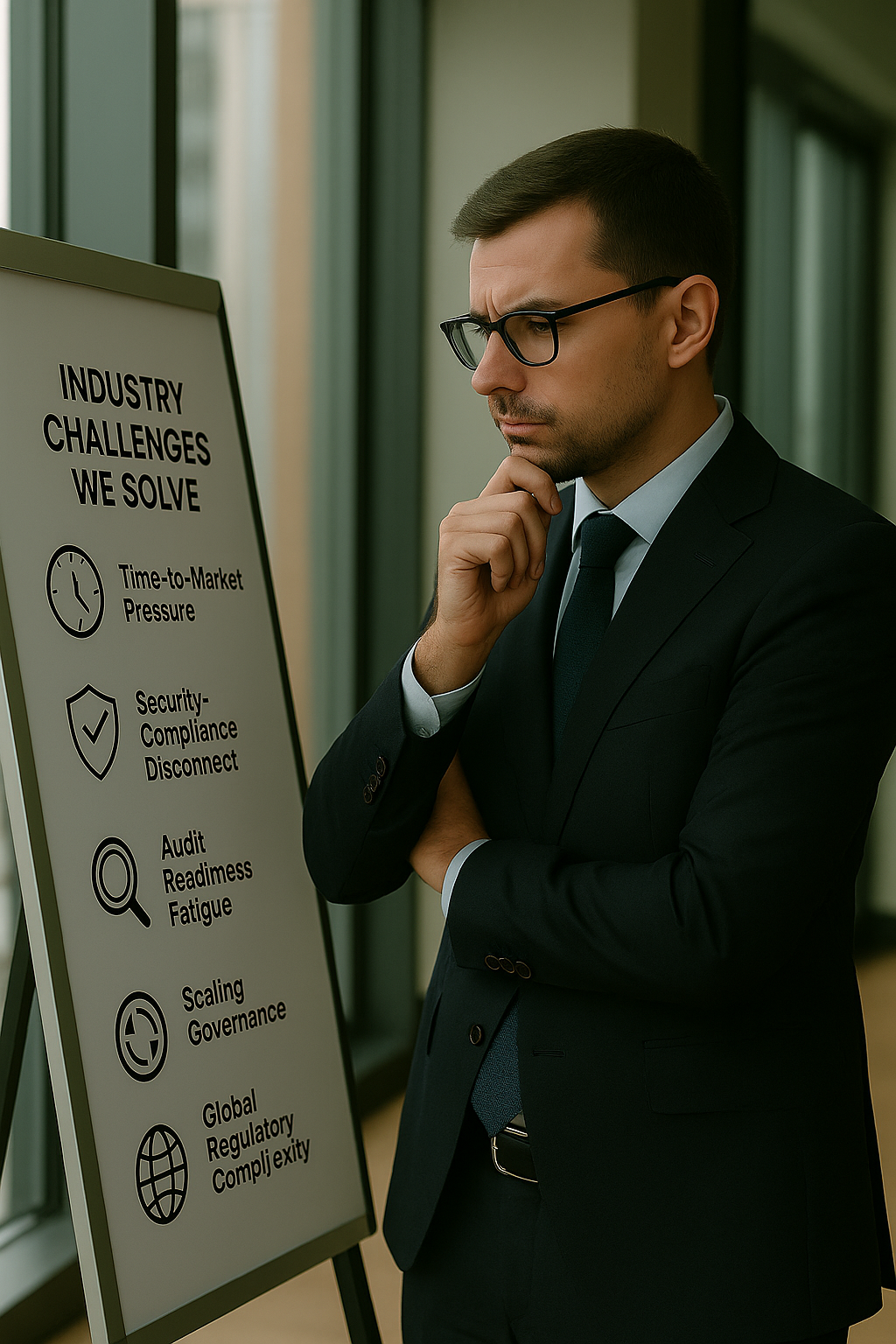

Industry Challenges We Solve

Time-to-Market Pressure

We accelerate GRC implementation without delaying product releases.

Security-Compliance Disconnect

We align engineering and GRC by translating control requirements into technical language.

Audit Readiness Fatigue

We operationalize readiness year-round—not just during audit season.

Scaling Governance

As you grow, we ensure controls remain effective across teams, regions, and partners.

Global Regulatory Complexity

Whether GDPR, RBI, CCPA, or PSD2—we tailor your program to regional nuances.

Methodology That Drives Fintech Compliance

We follow a phased, collaborative approach:

Discovery & Risk Profiling

Gain a comprehensive understanding of your regulatory footprint along with insights into your operational model and the current stage of your organizational maturity, as these elements are crucial for informed decision-making and effective risk management strategies.

Framework Mapping & Control Design

Tailor controls specifically to fit your unique business context, ensuring that you streamline processes and avoid any unnecessary overhead that can complicate operations and hinder efficiency.

Policy & Process Deployment

Implement comprehensive operational GRC workflows seamlessly into engineering, legal, HR, and product teams to enhance collaboration, streamline processes, and ensure alignment with organizational governance, risk management, and compliance objectives.

Training, Monitoring, and Reporting

Ensure your teams understand the importance of knowing the “why” behind controls as it fosters a culture of accountability and awareness. Be diligent in tracking gaps, surfacing potential risks, and accurately reporting metrics to create a comprehensive overview of compliance and performance.

Audit Readiness and Partner Support

We are here to stand by your side throughout every assessment process, whether it involves internal reviews or external evaluations, providing you with the support and expertise needed to navigate these critical moments with confidence and ease.

Proven GRC Leadership in the Fintech Sector

Expert-Led Engagements

All projects are led by certified GRC, audit, and risk professionals with fintech domain experience.

Built for Speed & Scale

Engineering-Literate

We work fluently with DevOps, security, and product teams to reduce implementation friction.

Audit-Proven Results

With a success rate exceeding 90 percent, our clients achieve their SOC 2 and ISO certifications on their very first try.